Charles Ward fell behind on his mortgage in September, just as his late wife began a losing battle with lung cancer and her medical costs soared.

His lender seized his $2,958 federal tax refund and has taken a $131 bite from each of his last four monthly Social Security checks.

"What little money I had saved up has just disappeared," says Mr. Ward, a 71-year-old former truck driver who bought his $128,000 home in Nelsonville, Ohio, in 2008. He receives about $200 a month in food stamps and takes on odd jobs to make ends meet.

Mr. Ward's lender isn't a bank. It is the U.S. Department of Agriculture's Rural Housing Service, which provides mortgage loans to rural homeowners and guarantees loans made by banks. It accounted for at least a third of all mortgages issued in 2010 in sparsely populated areas such as Morton County, Kan., and Sioux County, Neb., according to data reported under the Home Mortgage Disclosure Act.

Unlike private firms, the USDA doesn't need permission from a court to start collecting on unpaid debts. It can in some cases seize government benefits and tax refunds before a foreclosure is completed. After foreclosure, the USDA can go after unpaid balances, even in states that limit such actions by private lenders.

A USDA spokesman says the agency follows all federal and state laws.

[More from WSJ.com: Miami Beach Estate Goes on the Market for $45 Million]

The Treasury Department collected $45 million in delinquent USDA mortgage debt from borrowers in the last fiscal year, up from $23 million in fiscal 2007. At the end of fiscal 2011, $779.2 million in delinquent USDA mortgage debt was awaiting collection, up from $420.7 million in 2007.

The USDA is wielding its special powers even as the Obama administration is forcing private banks to give strapped homeowners a break. Under a $25 billion settlement over questionable foreclosure practices announced in February, five large banks agreed to slash loan balances and forgive the debt of borrowers who lost homes to foreclosure.

USDA Rural Housing Administrator Tammye Treviño says the agency strives to work with borrowers "to offer a path back to sustainability."

"Where these efforts aren't successful and the homeowner goes into foreclosure," she says, "we actually have a process that we are required by statute to follow to collect on the debts owed."

USDA officials say their actions are required by the federal Debt Collection Improvement Act of 1996, enacted well before the housing bust produced a wave of delinquencies. They say the agency came under pressure from its own Inspector General in 1999 and from the Government Accountability Office a few years later for being too soft on delinquent borrowers.

The USDA started making loans to farmers in 1949, then expanded its programs to other rural residents. A 1990 law allows it to guarantee bank loans issued by banks.

The agency is a small player in the overall mortgage market, holding or backing about 944,000 loans totaling $84.4 billion. That is less than 1% of the $9.4 trillion in U.S. mortgage debt outstanding.

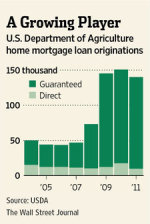

But since the mortgage crisis began in 2007, the USDA's loan volumes have tripled. The agency guaranteed $16.9 billion in loans in fiscal 2011, and issued $1.1 billion in direct loans.

Critics say the USDA's collection practices are troubling because the federal agency lends to low- and moderate-income homeowners, many of whom have been hurt by job losses and falling home prices. The USDA lets borrowers finance up to 102% of a home's value. About 12% of its guaranteed loans and 17% of direct loans are delinquent or in foreclosure.

[More from WSJ.com: Psst...Seen Any Mortgage-Securities Fraud?]

The agency is "pulling blood out of a stone," says Gideon Anders, an attorney with the National Housing Law Project who has sued the USDA on behalf of borrowers seeking loan workouts.

The USDA says guaranteed loans are generally not referred to collection until the foreclosed home has been sold and the lender has been paid. A spokesman said borrowers with loans issued directly by the USDA have "multiple opportunities" to avoid collection by working with the agency. He said USDA often negotiates settlements that reduce the debt amount or cancel it entirely—if the borrower shows no ability to pay.

While several federal agencies help consumers get mortgages, their collection standards vary greatly.

Since 2003, the USDA has required borrowers who take out a guaranteed loan to sign a form acknowledging the agency "will use all remedies available" to collect unpaid debt.

The Federal Housing Administration and Veterans Administration, which also guarantee mortgage loans issued by private lenders, say they generally don't pursue borrowers for debt left after foreclosure. "We'd gain nothing by placing an even greater debt burden on the borrower," an FHA spokeswoman says.

The VA says Congress in late 1989 enacted legislation preventing it from collecting deficiencies, except in cases of "fraud, misrepresentation or bad faith on the part of the veteran."

[Related: Where Home Prices Are Rising Fastest]

Some borrowers now say they didn't know what they agreed to when they signed the USDA form. "It was a shock when I got the note that they were going to garnish my Social Security check," says Jeanne Marie Andersen, a 74-year-old widow who lives in Lake Crystal, Minn., and took out a USDA loan in 2007.

Ms. Andersen lost her home to foreclosure in 2010, after she lost her job as a cook at a local restaurant. She now receives food stamps and lives in low-income housing.

She filed for bankruptcy protection in February to block the USDA from taking $113 a month from her $863 Social Security check to repay some of the roughly $50,000 she owes the government.

USDA officials declined to comment on specific examples for reasons of borrower privacy, but said that agency staff inform borrowers seeking direct loans of their repayment obligations before the loan is completed. They say lenders making guaranteed loans are responsible for making sure borrowers understand their responsibilities.

The Treasury Department handles USDA collections of delinquent debt. Its arsenal includes taking tax refunds, seizing up to 15% of Social Security payments and garnishing up to 15% of a borrower's take-home pay. It can also tack on up to 28% to cover collection costs.

On guaranteed loans, the USDA's ability to pursue collections often turns on whether the borrower has signed a single piece of paper tucked in a pile of mortgage closing documents.

Antonio Ponce, 40, and Alicia Arambula, 34, got a USDA-guaranteed mortgage from a broker in 2005. The couple lost their jobs at chicken farms in July 2009, and J.P. Morgan Chase & Co., which had purchased the loan from the mortgage broker, foreclosed on their Albertville, Ala., home later that year. The USDA in August 2011 began garnishing the wages Mr. Ponce now earns as a construction worker to collect a $48,300 debt, including fees.

During a hearing before an administrative law judge in October 2011, the couple said they never signed the form obligating them to reimburse the government for any losses. A USDA attorney acknowledged the signature didn't match Mr. Ponce's signatures on other documents, according to a hearing transcript. The agency dropped the claim. A spokeswoman for J.P. Morgan declined to comment.

The USDA says that of the 984 borrowers who appealed USDA collections and other adverse actions in fiscal 2011, the agency's position was upheld roughly 90% of the time. A spokesman said the agency "seeks to ensure that all paperwork is correctly and properly executed" prior to guaranteeing the loan.

The USDA has the power to collect on debts owed after a foreclosure, even in states where similar actions by private lenders would violate the law.

Matthew Earl, a maintenance worker, took out a $74,000 USDA-backed loan in 2006 to buy a three-bedroom home in Chickasha, Okla. Mr. Earl, 28, lost the home to foreclosure in 2009. J.P. Morgan Chase sold the home in April 2010 for $55,500, according to an administrative order filed in the case. After making J.P. Morgan whole, the USDA began garnishing Mr. Earl's wages and seized his roughly $7,000 tax refund.

Under Oklahoma law, lenders must go to court within 90 days of a completed foreclosure to secure the right to collect leftover debt, says Mr. Earl's attorney, Mark T. Hamby, adding that J.P. Morgan didn't do so. But in a February decision, an administrative law judge found the guarantee form Mr. Earl signed gave the USDA a separate right to garnish his wages. A J.P. Morgan spokeswoman declined to comment.

In this case, the government collected more from Mr. Earl than the 15% permitted by federal law, according to the administrative order. The judge ordered the USDA to repay Mr. Earl and allowed the government to garnish only 5% of his disposable pay until March 2013 to repay the $42,200 debt, including collection costs. A higher amount would cause "financial hardship," according to the order, which noted that Mr. Earl couldn't afford to pay for his wife's health insurance and had pulled his daughter out of prekindergarten.

Both the USDA and Treasury Department declined to comment on individual cases, but Ronda Kent, a Treasury official overseeing the debt-collection program, said garnishment calculations are done by the employer using a Treasury Department form.

The USDA's policies are restrictive when it comes to modifications by lenders of guaranteed loans and the agency has been less flexible than banks in reworking direct loans, says Dan Williams, program director for LSS Financial Counseling Service in Duluth, Minn.

For the private loans the USDA guarantees, the agency since late 2010 has had its own version of the Obama administration's Home Affordable Modification Program, which aims to make troubled loans more affordable. Through March, 10 such modifications had been completed. Overall, lenders completed about 354,000 modifications under the Obama program last year, according to Hope Now, an industry group.

[More from WSJ.com: Summertime, And the Reading is Plentiful]

The USDA says it has approved 215 modifications under the program, with 67 canceled by the lenders and 138 awaiting completed paperwork.

For loans made directly to borrowers, the agency sometimes cuts the interest rate or suspends payments for up to two years. A seven-month payment holiday helped Mary Beall avoid falling behind on her $142,000 USDA mortgage after she was seriously injured in a car wreck in 2009.

"They took care of me until I went back to work," says Ms. Beall, who couldn't return to work for more than four months because of her injuries.

About 4,000 borrowers are currently on payment holidays, according to USDA officials. Roughly 8,900 borrowers are on repayment plans, the USDA says. Banks last year completed more than one million modifications, according to Hope Now.

There is another difference: While the government has pressed private banks to reduce homeowners' monthly payments, USDA borrowers who receive payment holidays often end up with even higher payments later.

That is because the USDA adds unpaid amounts onto the loan balances—and then raises the monthly payment so the loan can be repaid in the same time. A USDA spokesman says the agency is required to take such actions.

Roger Beebe, a 56-year-old factory worker, took out a $42,500 USDA direct loan to buy his home in Marietta, Ohio, in 1982 and another $4,280 loan in 1995 to fix it up. When Mr. Beebe was laid off in 2009, the USDA gave him a two-year payment holiday. But when the term expired, the government raised his payments to $669 from about $150 so the larger mortgage could be repaid on time.

Mr. Beebe says he can't afford the higher payments. The USDA sent him a foreclosure notice last summer and this year seized his $945 tax refund. "It's hard for me to understand what they were trying to achieve," says Mr. Beebe, who now earns $8.50 an hour and expects to file for bankruptcy.

His lender seized his $2,958 federal tax refund and has taken a $131 bite from each of his last four monthly Social Security checks.

"What little money I had saved up has just disappeared," says Mr. Ward, a 71-year-old former truck driver who bought his $128,000 home in Nelsonville, Ohio, in 2008. He receives about $200 a month in food stamps and takes on odd jobs to make ends meet.

Mr. Ward's lender isn't a bank. It is the U.S. Department of Agriculture's Rural Housing Service, which provides mortgage loans to rural homeowners and guarantees loans made by banks. It accounted for at least a third of all mortgages issued in 2010 in sparsely populated areas such as Morton County, Kan., and Sioux County, Neb., according to data reported under the Home Mortgage Disclosure Act.

Unlike private firms, the USDA doesn't need permission from a court to start collecting on unpaid debts. It can in some cases seize government benefits and tax refunds before a foreclosure is completed. After foreclosure, the USDA can go after unpaid balances, even in states that limit such actions by private lenders.

A USDA spokesman says the agency follows all federal and state laws.

[More from WSJ.com: Miami Beach Estate Goes on the Market for $45 Million]

The Treasury Department collected $45 million in delinquent USDA mortgage debt from borrowers in the last fiscal year, up from $23 million in fiscal 2007. At the end of fiscal 2011, $779.2 million in delinquent USDA mortgage debt was awaiting collection, up from $420.7 million in 2007.

The USDA is wielding its special powers even as the Obama administration is forcing private banks to give strapped homeowners a break. Under a $25 billion settlement over questionable foreclosure practices announced in February, five large banks agreed to slash loan balances and forgive the debt of borrowers who lost homes to foreclosure.

USDA Rural Housing Administrator Tammye Treviño says the agency strives to work with borrowers "to offer a path back to sustainability."

"Where these efforts aren't successful and the homeowner goes into foreclosure," she says, "we actually have a process that we are required by statute to follow to collect on the debts owed."

USDA officials say their actions are required by the federal Debt Collection Improvement Act of 1996, enacted well before the housing bust produced a wave of delinquencies. They say the agency came under pressure from its own Inspector General in 1999 and from the Government Accountability Office a few years later for being too soft on delinquent borrowers.

The USDA started making loans to farmers in 1949, then expanded its programs to other rural residents. A 1990 law allows it to guarantee bank loans issued by banks.

The agency is a small player in the overall mortgage market, holding or backing about 944,000 loans totaling $84.4 billion. That is less than 1% of the $9.4 trillion in U.S. mortgage debt outstanding.

But since the mortgage crisis began in 2007, the USDA's loan volumes have tripled. The agency guaranteed $16.9 billion in loans in fiscal 2011, and issued $1.1 billion in direct loans.

Critics say the USDA's collection practices are troubling because the federal agency lends to low- and moderate-income homeowners, many of whom have been hurt by job losses and falling home prices. The USDA lets borrowers finance up to 102% of a home's value. About 12% of its guaranteed loans and 17% of direct loans are delinquent or in foreclosure.

[More from WSJ.com: Psst...Seen Any Mortgage-Securities Fraud?]

The agency is "pulling blood out of a stone," says Gideon Anders, an attorney with the National Housing Law Project who has sued the USDA on behalf of borrowers seeking loan workouts.

The USDA says guaranteed loans are generally not referred to collection until the foreclosed home has been sold and the lender has been paid. A spokesman said borrowers with loans issued directly by the USDA have "multiple opportunities" to avoid collection by working with the agency. He said USDA often negotiates settlements that reduce the debt amount or cancel it entirely—if the borrower shows no ability to pay.

While several federal agencies help consumers get mortgages, their collection standards vary greatly.

Since 2003, the USDA has required borrowers who take out a guaranteed loan to sign a form acknowledging the agency "will use all remedies available" to collect unpaid debt.

The Federal Housing Administration and Veterans Administration, which also guarantee mortgage loans issued by private lenders, say they generally don't pursue borrowers for debt left after foreclosure. "We'd gain nothing by placing an even greater debt burden on the borrower," an FHA spokeswoman says.

The VA says Congress in late 1989 enacted legislation preventing it from collecting deficiencies, except in cases of "fraud, misrepresentation or bad faith on the part of the veteran."

[Related: Where Home Prices Are Rising Fastest]

Some borrowers now say they didn't know what they agreed to when they signed the USDA form. "It was a shock when I got the note that they were going to garnish my Social Security check," says Jeanne Marie Andersen, a 74-year-old widow who lives in Lake Crystal, Minn., and took out a USDA loan in 2007.

Ms. Andersen lost her home to foreclosure in 2010, after she lost her job as a cook at a local restaurant. She now receives food stamps and lives in low-income housing.

She filed for bankruptcy protection in February to block the USDA from taking $113 a month from her $863 Social Security check to repay some of the roughly $50,000 she owes the government.

USDA officials declined to comment on specific examples for reasons of borrower privacy, but said that agency staff inform borrowers seeking direct loans of their repayment obligations before the loan is completed. They say lenders making guaranteed loans are responsible for making sure borrowers understand their responsibilities.

The Treasury Department handles USDA collections of delinquent debt. Its arsenal includes taking tax refunds, seizing up to 15% of Social Security payments and garnishing up to 15% of a borrower's take-home pay. It can also tack on up to 28% to cover collection costs.

On guaranteed loans, the USDA's ability to pursue collections often turns on whether the borrower has signed a single piece of paper tucked in a pile of mortgage closing documents.

Antonio Ponce, 40, and Alicia Arambula, 34, got a USDA-guaranteed mortgage from a broker in 2005. The couple lost their jobs at chicken farms in July 2009, and J.P. Morgan Chase & Co., which had purchased the loan from the mortgage broker, foreclosed on their Albertville, Ala., home later that year. The USDA in August 2011 began garnishing the wages Mr. Ponce now earns as a construction worker to collect a $48,300 debt, including fees.

During a hearing before an administrative law judge in October 2011, the couple said they never signed the form obligating them to reimburse the government for any losses. A USDA attorney acknowledged the signature didn't match Mr. Ponce's signatures on other documents, according to a hearing transcript. The agency dropped the claim. A spokeswoman for J.P. Morgan declined to comment.

The USDA says that of the 984 borrowers who appealed USDA collections and other adverse actions in fiscal 2011, the agency's position was upheld roughly 90% of the time. A spokesman said the agency "seeks to ensure that all paperwork is correctly and properly executed" prior to guaranteeing the loan.

The USDA has the power to collect on debts owed after a foreclosure, even in states where similar actions by private lenders would violate the law.

Matthew Earl, a maintenance worker, took out a $74,000 USDA-backed loan in 2006 to buy a three-bedroom home in Chickasha, Okla. Mr. Earl, 28, lost the home to foreclosure in 2009. J.P. Morgan Chase sold the home in April 2010 for $55,500, according to an administrative order filed in the case. After making J.P. Morgan whole, the USDA began garnishing Mr. Earl's wages and seized his roughly $7,000 tax refund.

Under Oklahoma law, lenders must go to court within 90 days of a completed foreclosure to secure the right to collect leftover debt, says Mr. Earl's attorney, Mark T. Hamby, adding that J.P. Morgan didn't do so. But in a February decision, an administrative law judge found the guarantee form Mr. Earl signed gave the USDA a separate right to garnish his wages. A J.P. Morgan spokeswoman declined to comment.

In this case, the government collected more from Mr. Earl than the 15% permitted by federal law, according to the administrative order. The judge ordered the USDA to repay Mr. Earl and allowed the government to garnish only 5% of his disposable pay until March 2013 to repay the $42,200 debt, including collection costs. A higher amount would cause "financial hardship," according to the order, which noted that Mr. Earl couldn't afford to pay for his wife's health insurance and had pulled his daughter out of prekindergarten.

Both the USDA and Treasury Department declined to comment on individual cases, but Ronda Kent, a Treasury official overseeing the debt-collection program, said garnishment calculations are done by the employer using a Treasury Department form.

The USDA's policies are restrictive when it comes to modifications by lenders of guaranteed loans and the agency has been less flexible than banks in reworking direct loans, says Dan Williams, program director for LSS Financial Counseling Service in Duluth, Minn.

For the private loans the USDA guarantees, the agency since late 2010 has had its own version of the Obama administration's Home Affordable Modification Program, which aims to make troubled loans more affordable. Through March, 10 such modifications had been completed. Overall, lenders completed about 354,000 modifications under the Obama program last year, according to Hope Now, an industry group.

[More from WSJ.com: Summertime, And the Reading is Plentiful]

The USDA says it has approved 215 modifications under the program, with 67 canceled by the lenders and 138 awaiting completed paperwork.

For loans made directly to borrowers, the agency sometimes cuts the interest rate or suspends payments for up to two years. A seven-month payment holiday helped Mary Beall avoid falling behind on her $142,000 USDA mortgage after she was seriously injured in a car wreck in 2009.

"They took care of me until I went back to work," says Ms. Beall, who couldn't return to work for more than four months because of her injuries.

About 4,000 borrowers are currently on payment holidays, according to USDA officials. Roughly 8,900 borrowers are on repayment plans, the USDA says. Banks last year completed more than one million modifications, according to Hope Now.

There is another difference: While the government has pressed private banks to reduce homeowners' monthly payments, USDA borrowers who receive payment holidays often end up with even higher payments later.

That is because the USDA adds unpaid amounts onto the loan balances—and then raises the monthly payment so the loan can be repaid in the same time. A USDA spokesman says the agency is required to take such actions.

Roger Beebe, a 56-year-old factory worker, took out a $42,500 USDA direct loan to buy his home in Marietta, Ohio, in 1982 and another $4,280 loan in 1995 to fix it up. When Mr. Beebe was laid off in 2009, the USDA gave him a two-year payment holiday. But when the term expired, the government raised his payments to $669 from about $150 so the larger mortgage could be repaid on time.

Mr. Beebe says he can't afford the higher payments. The USDA sent him a foreclosure notice last summer and this year seized his $945 tax refund. "It's hard for me to understand what they were trying to achieve," says Mr. Beebe, who now earns $8.50 an hour and expects to file for bankruptcy.

No comments:

Post a Comment